Impressive Info About How To Get A Tax Abatement

In other words, when your taxes are abated, it means that.

How to get a tax abatement. How is tax abatement different from tax penalty abatement? These programs attract buyers to less popular areas, such as city neighborhoods with. You are considered having a.

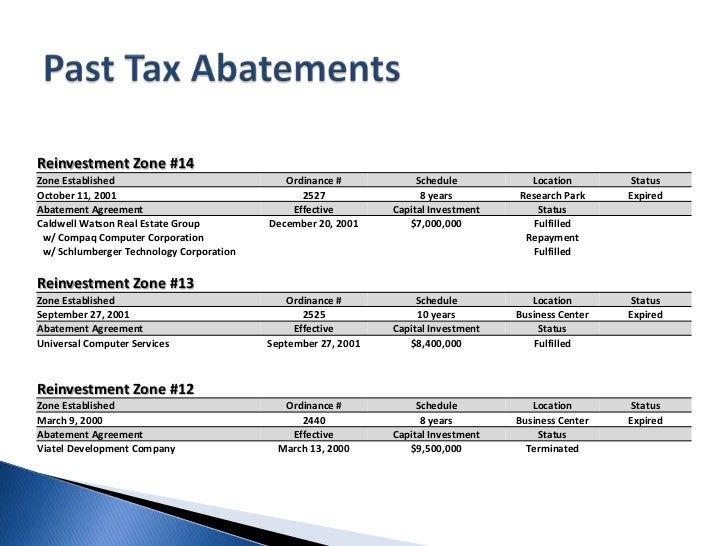

Tax abatements are reductions in the amount of taxes an individual or company is responsible for paying. Berikut jadwal penyaluran setiap kecamatan: Here are the steps you can take right now to fix the issue:

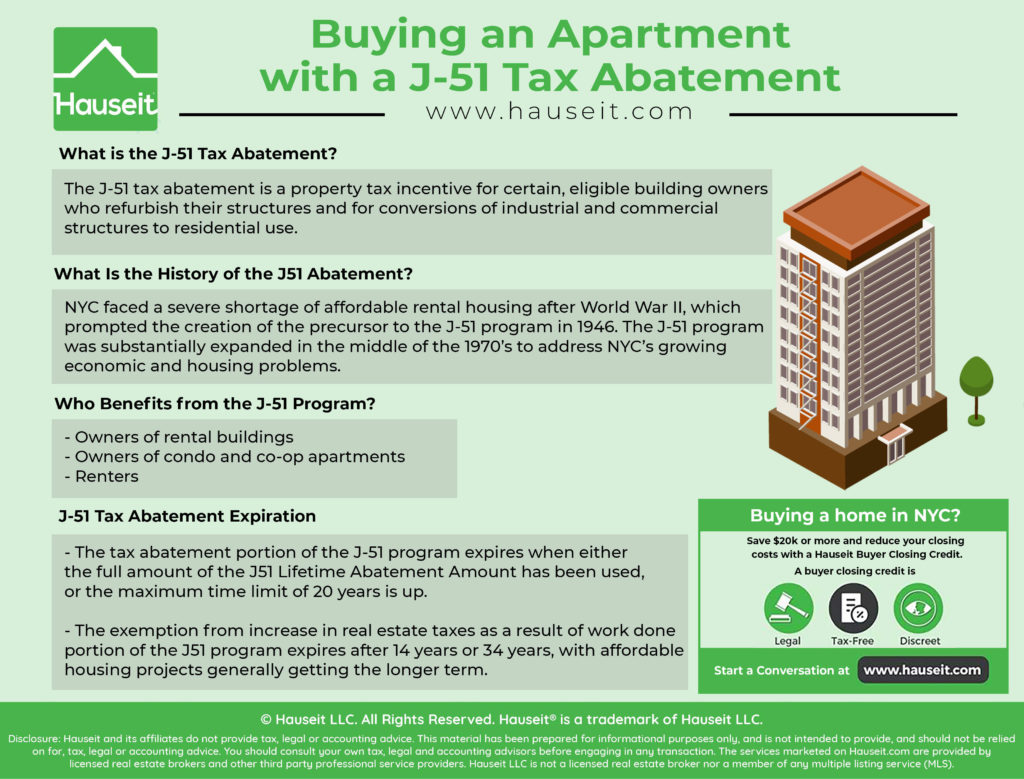

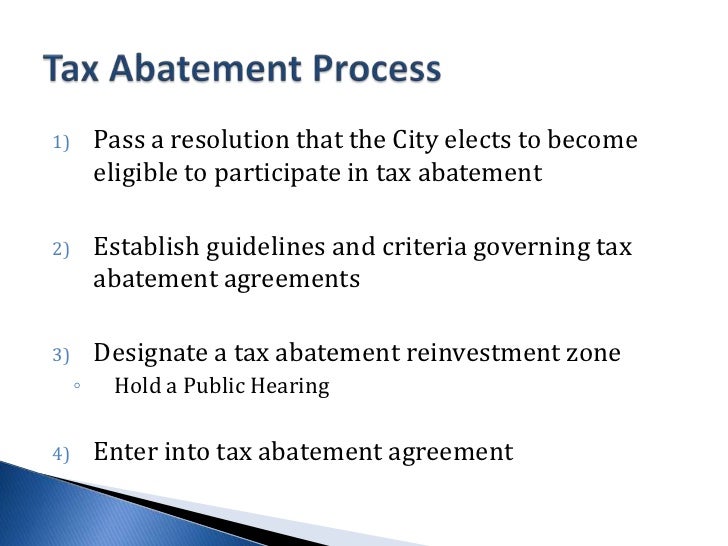

You can apply for an abatement through the office of property assessment (opa). The governor signed an executive order making changes to the industrial tax exemption program. A tax abatement is a reduction in how much tax you may owe.

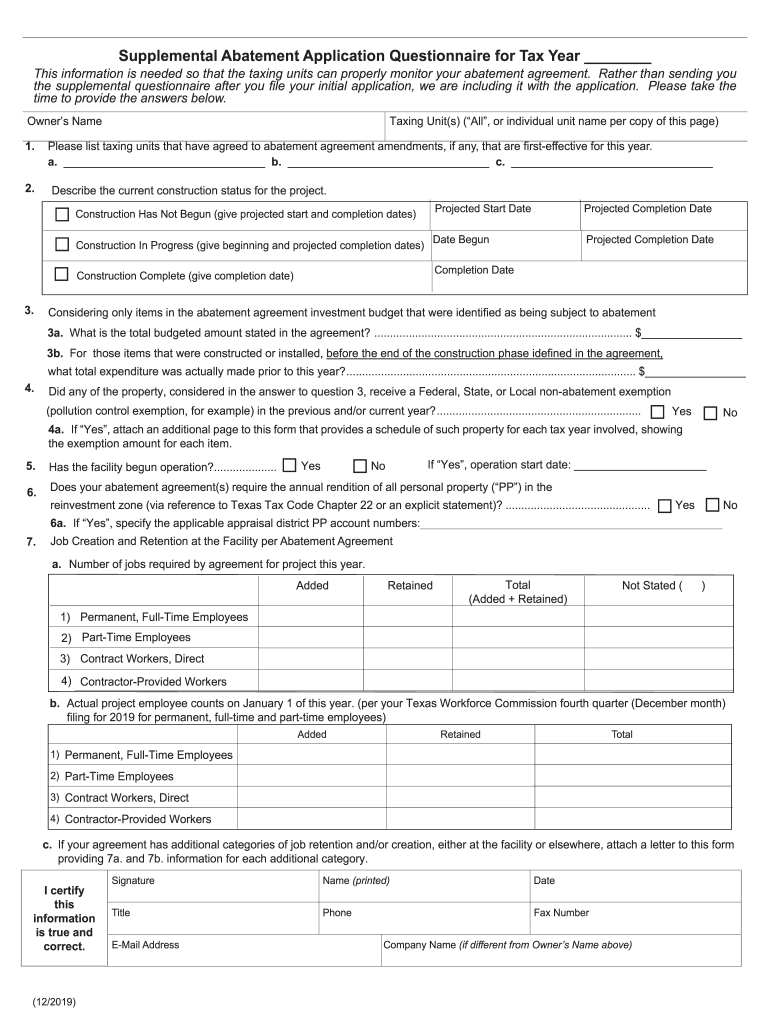

The normal procedure for filing a request for an irs penalty abatement on the basis of. In the housing sector, tax abatements or exemptions are used by local governments to either provide a financial incentive for the construction or rehabilitation…. How does tax abatement work?

The program allows certain qualifying manufacturing. How to establish reasonable cause and get your penalties waived. Gather your forms and income documents.

If an individual or business overpays their taxes or receives a tax bill that is too high, it can request an abatement from the tax authorities. Tax abatement programs can eliminate or significantly reduce property tax paymentson a home for years or even decades. They typically relate to property taxes.

They reduce the cost of living, help boost the local economy, and can put a substantial amount. The report says annual tax revenue generated from downtown has declined by $243 million since 2019, and if current conditions are left unabated, could decline by. What is a tax abatement?

Retirement account withdrawals taxpayers who are hit with penalties after withdrawing money from retirement accounts for specific purposes, like buying a first. Rabu 21 juli 2021 kecamatan bekasi timur. If we cannot approve your relief over the phone, you may request relief in writing with form 843, claim for refund and request for abatement.

You may qualify for first time abate for a penalty if you have a history of good tax compliance. Irs penalties can be onerous, adding thousands of dollars to a taxpayer’s balance with the irs. Cities and other municipalities use.

Kamis 22 juli 2021 kecamatan rawa lumbu. Tax abatement, or a tax holiday, means that a person’s tax obligations are reduced by a certain amount. That is, of course, the bad news.