Who Else Wants Tips About How To Claim Tax Relief On Pension Contributions

You claim relief for retirement annuity contract (rac) or.

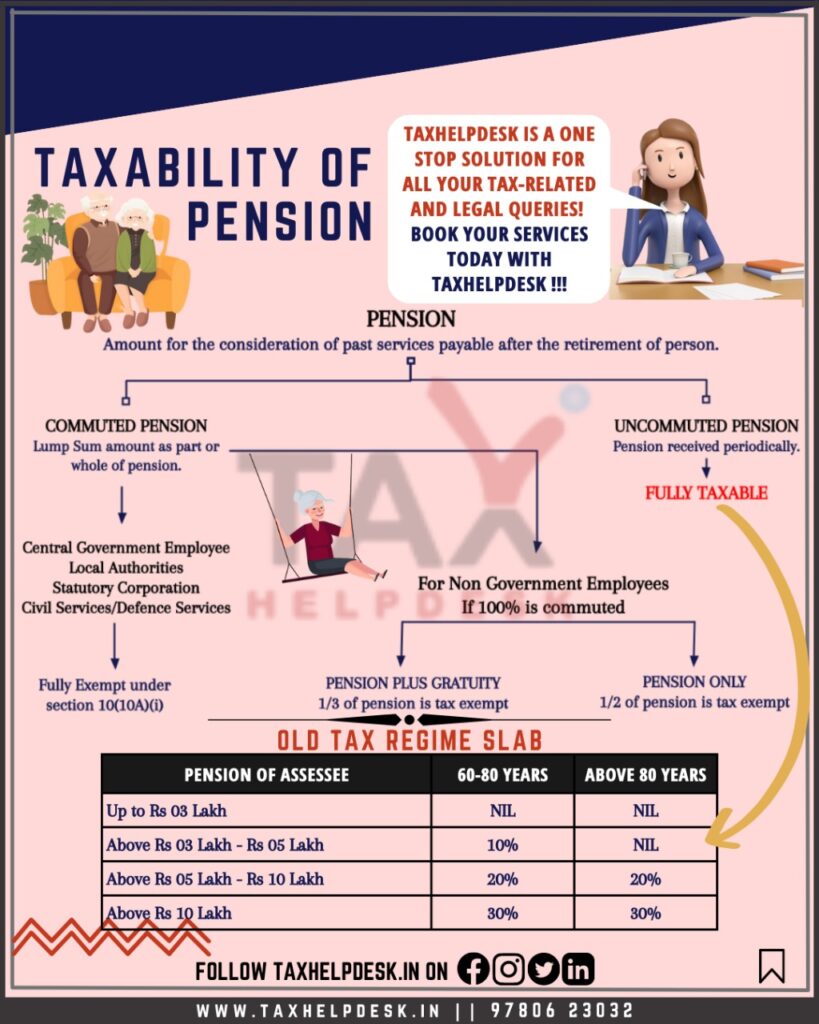

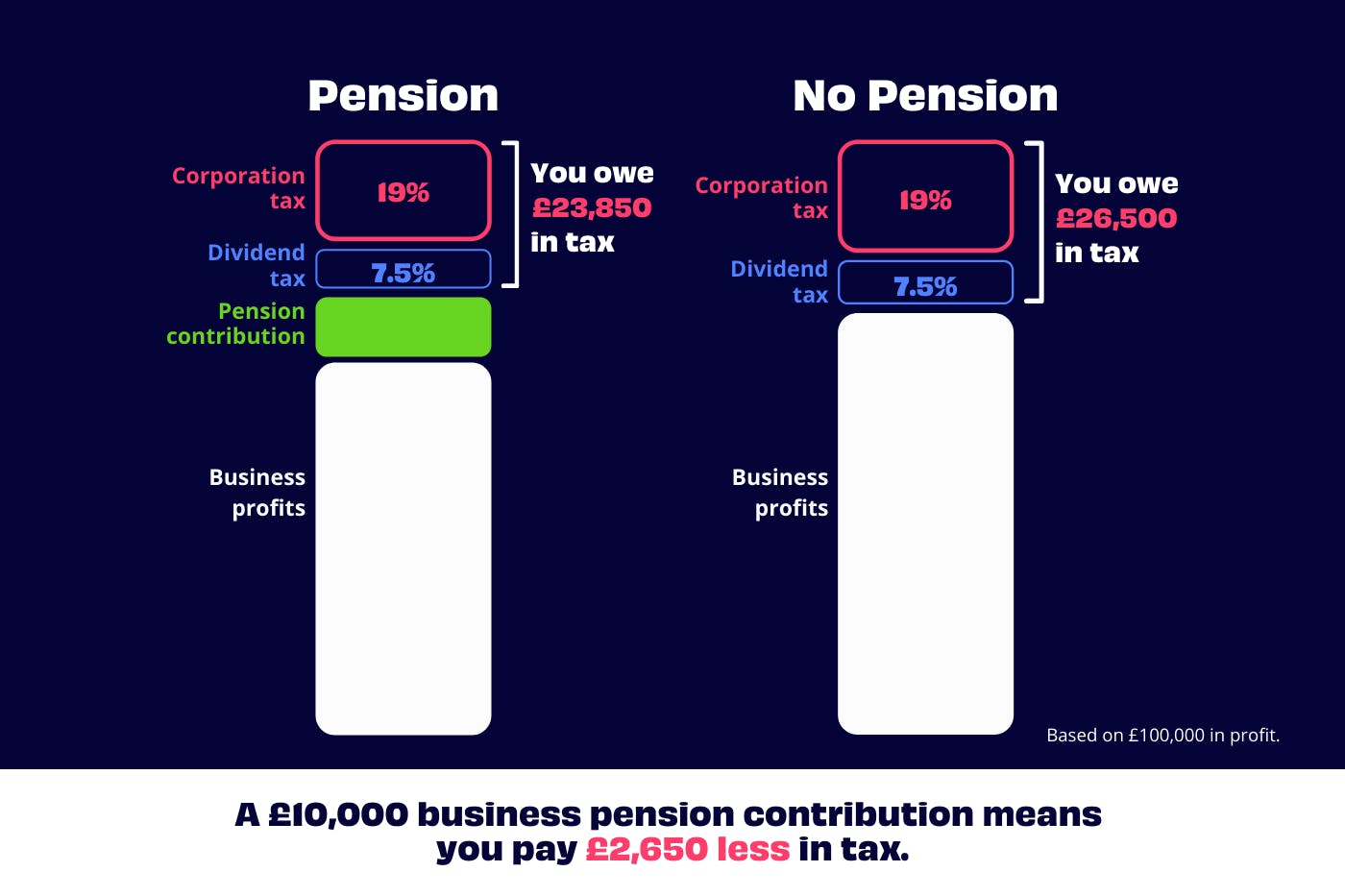

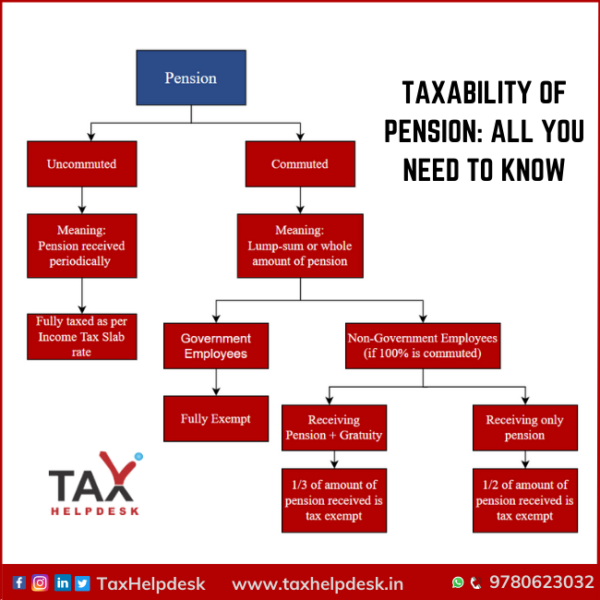

How to claim tax relief on pension contributions. You claim relief for additional voluntary contributions (avcs) through the ‘paye/bik/pensions’ panel. There are 2 ways you can claim pension tax relief, which your employer will set up on your workplace pension scheme… net pay arrangement this is when your employer takes. That works out as a 66% tax bonus.

But there are limits on how much tax relief will apply. You can get income tax relief against earnings from your employment for your pension contributions (including additional voluntary contributions (avcs). £55 of your money means £100 in your.

You can make backdated claims for higher rate tax relief on your pension contributions, although there is a time limit as you can only claim back tax relief for the. You get relief at source in all personal and stakeholder pensions. If you’re a uk taxpayer and under the age of 75, every tax year you may be able to get tax relief on pension contributions up to 100% of your earnings, or on contributions up.

You can claim tax relief on your pension for the previous 4 tax years, not including the current tax year. They would claim £250 in. These are known as relief at source and net pay.

Home paying into pensions tax relief on pension contributions from 6 january 2024, the main rate of class 1 national insurance contributions (nic) deducted. This is 100% of your earnings on contributions you make. For additional rate taxpayers, you'll enjoy 45% tax relief on each contribution.

So if you earn £20,000, then your limit would be. If you pay a higher rate of tax and are contributing to a pension, you are entitled to extra relief and you need to claim. Retirement how can i claim a tax relief on my pension contributions?

18 jan 2024 pension tax relief calculator calculate how much tax relief you can get on your pension in the latest tax year. There are two ways you can get tax relief on your pension contributions. You may need to claim your tax relief yourself if:

Pd paul davies when you save into a pension, the. You can claim an extra 20% tax relief on £30,000 (the amount you paid higher rate tax on) through your return or by writing to the tax office. Tax relief is paid on your pension contributions at the highest rate of income tax you pay.