Casual Tips About How To Claim Back Tax For Students

Borrowers who had their federal student loans forgiven last year won't pay federal taxes.

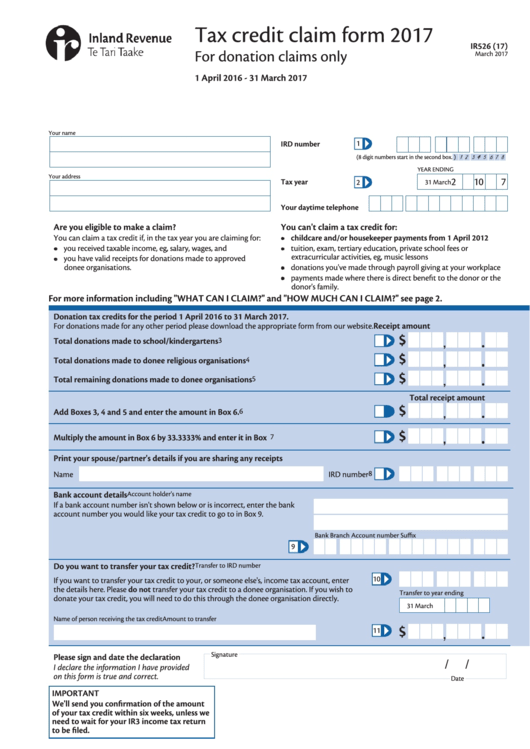

How to claim back tax for students. But the good news is that you can claim this cost as a tax deduction on your. Can you claim back tax? If you have earned more than $18,200 you will need to lodge a tax return at the end of the financial year.

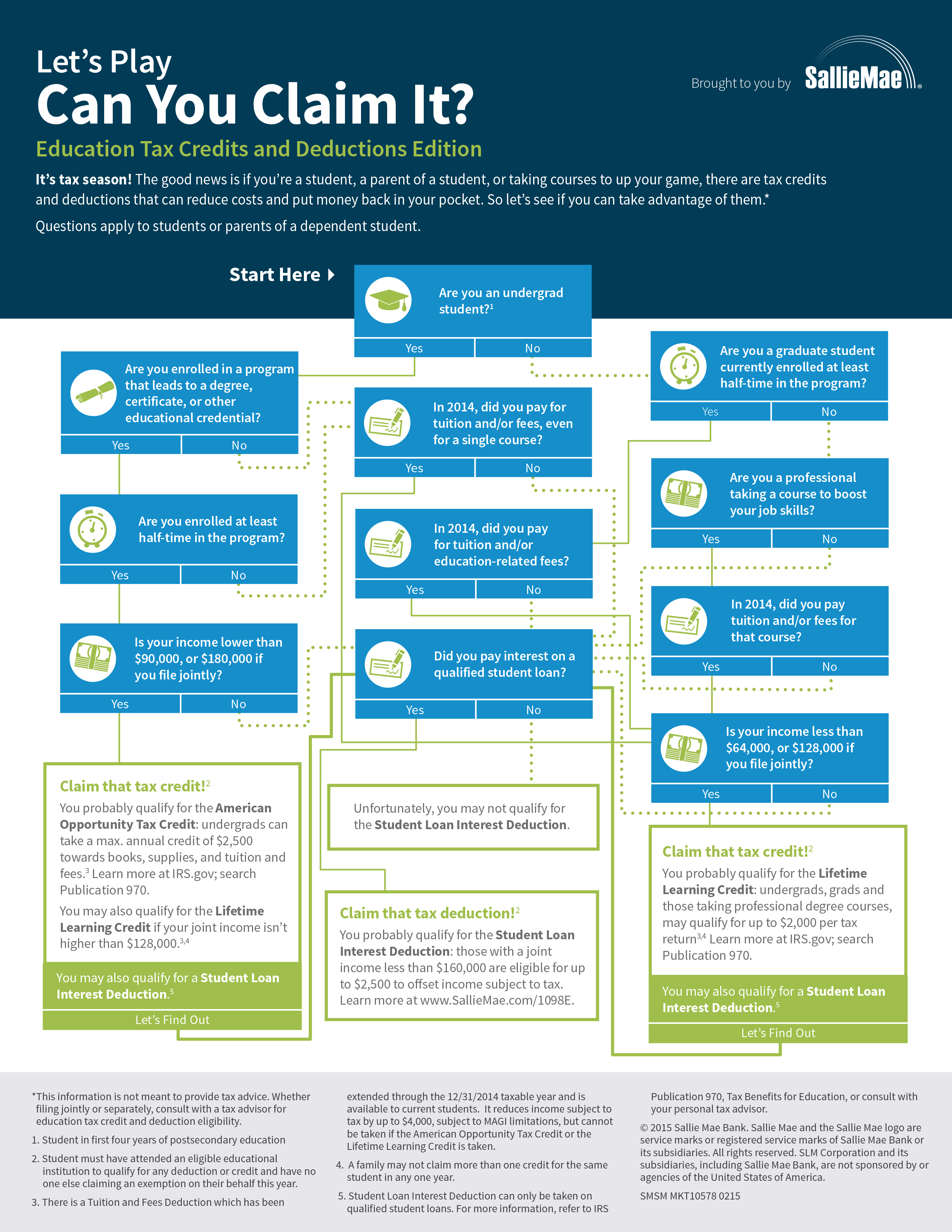

If you have student loans or pay education costs for yourself, you may be eligible to claim education deductions and credits on your tax return, such as loan. During this period, the amounts of forgiven student loan debt won’t be subject to federal taxation.”. Washington — during the busiest time of the tax filing season, the internal revenue service kicked off its 2024 tax time guide series to help.

The maximum aotc is $2,500 per student. But they could owe their state. If you want to claim back tax you must furnish the required information and.

See periods of unemployment for more information on what to do when. You get a 100% credit for the first $2,000 spent on qualified education expenses during 2023 and a 25% credit for the next. If you have earned less than this amount in the past financial year, and.

National insuranceif you earn more than £190 a week your employer will usually deduct income tax and national insurance from your wages through pay as you earn (paye). Key takeaways filing taxes as a student can be daunting, but it’s important to understand how the tax system works in order to save money and avoid penalties. This is especially true if you’re paid under the ‘pay as you earn’ scheme where students are often overtaxed.

If you think you have overpaid tax, you may be eligible for a tax rebate. February 26, 2024, 8:11 am pst. Can international students claim tax back?

Start your refund application students tax returns if you worked and earned income while in australia as an international student, you may be entitled to claim tax. True, you will incur a fee when filing with taxback.com (learn more about our fees here). If you leave a job to return to full time education, you may be entitled to claim tax back.

Worth a maximum benefit of up to $2,500 per eligible student. Tax refunds for students. So, why leave your money with the tax man?

The amount a family can receive is up to $2,000 per child, but it's only partially refundable. That means if not all is applied to any taxes you owe to lower your tax bill,. You can apply for a tax refund by filing a tax return because you most likely overpaid taxes as well.

But the department warns that despite the federal tax exemption for. Filing a tax return with the irs, gathering necessary documentation, and exploring tax treaty benefits are necessary steps for claiming an f1 visa tax refund. The american opportunity tax credit is: